You know, I never yelled, “YOLO,” once when it was a popular phrase. “You only live once,” was a phrase the kids used to say to before verbally inspiring themselves to perform ambitious stunts. It’s a dated phrase and I am struck by how the term spread like wildfire. It reminds today of how middle-aged people use terms like, “lit,” to perhaps feel young or culturally in-the-know. Or most probably, to not feel left out. It’s amazing what sensible people will do when gripped by a fear of missing out, a reaction also called, “FOMO.” The FOMO mindset can have tragic and/or comic consequences for the well-meaning but misinformed middle-aged mindset. Especially when it comes to decisions related to retirement. That is why fear of missing out could hurt retirement prospects.

The average person retires at the age of 62.

Some young entrepreneurs are aspiring to retire in their 30s, 40s or 50s via the, “Financial Independence, Retire Early,” or FIRE movement.

The sad reality is that many Americans are not prepared for retirement. Too many wait until they are middle aged or of retirement age to even contemplate retirement.

This is when the FOMO mindset kicks in.

In the rush to try to make the right decision, especially relative to focusing on what others do instead of on custom needs, people can make disastrous retirement decisions.

There are many ways the FOMO mindset can hurt your retirement prospects.

Before we get into all of that, let’s talk at the FOMO mindset and retirement.

Fear of Missing Out Could Hurt Retirement Prospects

The FOMO mindset is the unshakable suspicion that others are having appealing and rewarding experiences that only you are missing out on.

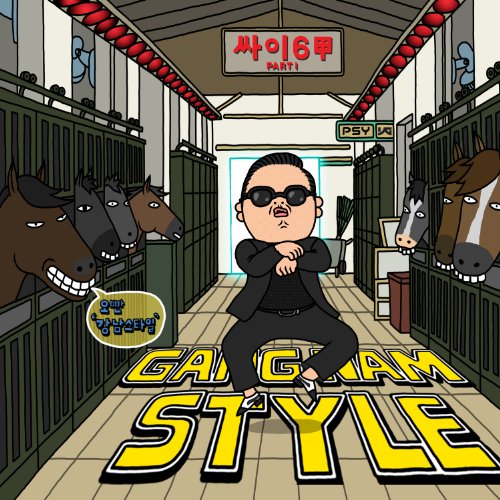

Do you remember the Macarena or Gangnam Style dance crazes? Every few years, there is a cultural craze, like a dance, that everyone has to try. Why? So as not to feel left out of the hype. If you were alive in 2013, chances are good that you did the Gangnam Style dance at least once. That is a basic example of the FOMO mindset. Goofy dances aside, the FOMO mindset can wreak havoc relative to investments and retirement decisions.

Let’s talk about FOMO relative to investment. For example, in the 1990s, people gave up on their diversified portfolios and invested heavily in technology.

The internet was new and smartphone technology was over a decade away. However, those were early days of speculation and there was a “dotcom,” bubble. The dotcom bubble occurred 20 years ago because of FOMO mindset gripping investors.

The greatest example of FOMO investing is the recent cryptocurrency craze. In December 2017, the value of one bitcoin was $20,000.

It takes a lot of computing power, expensive specialized computer equipment, and energy to mine cryptocurrencies.

Gripped by FOMO, investors scrambled to invest in cryptos because everyone else was doing it.

By 2018, people were losing fortunes because they couldn’t recoup their startup costs.

The time to invest in cryptos was in 2009, when they were newly created cryptos given away for free or pennies. Those early crypto investors made fortunes recently, not the 2018 FOMO crypto crowd. Notice how no one talks about cryptos anymore like in 2018? The FOMO craze settled down.

The point is that the FOMO mindset can destroy your retirement before you even start.

FOMO-Initiated Investment Choices

Did you know that 1-in-3 Americans have absolutely nothing saved for their retirement? About half of Americans have $0 saved for their eventual retirement.

Most people think that you need $1 million dollars to budget a retirement. That is an arbitrary estimate that was developed in the 1980s and accepted as personal finance gospel.

How much you would need for a comfortable retirement depends entirely on your unique personal circumstances.

Many retirees live on fixed incomes and sometimes need to take on part-time work to supplement their budgets.

Your budget, cost of living standards relative to where you live, and health expenses ultimately determine your retirement.

Some financial experts believe you need $3 million to comfortably live out a retirement, especially if you live in a large city. You must consider cost of living calculations to have a comfortable retirement.

The problem with retirement is that most people don’t consider its importance until they see how others are living out their retirement.

Then, the FOMO-mindset kicks in and dire mistakes are made.

Some people don’t seriously think about retirement until they notice their friends or neighbors retiring to travel the world. Or, they notice peers retiring so they can volunteer, become consultants, or live out the remainder of their lives comfortably on their own terms. This shouldn’t be the spark of envy to begin panic investing to live similarly.

Many retirees can invest against their 401(k) or retirement plan. This isn’t a good idea unless you have performed meticulous research and understand that it can take years to realize an ROI.

Catching up with the Joneses or scratching a FOMO-manifested itch after witnessing another’s retirement, can cause bad investment choices.

Never make rushed investment decisions regarding your retirement borne from FOMO panic. Fear of missing out could hurt retirement prospects severely if you don’t pay attention.

Assuming Unnecessary Debt to Quell FOMO Panic

There are many people who began saving money for their retirement in their 20s and 30s. They made sound investments. And, they saved more money than they spent.

Such retirees are the exception, not the rule. Still, if you see people in their 60s and 70s traveling the world, reveling in hobbies, and spending time as consultants, its because they have sound retirement plans.

Many retirees live on a fixed income, contemplate going to work again, and live uncertain existences on a day-to-day basis.

Over 76% of people aged 56 to 76, also known as Baby Boomers, haven’t saved enough money for retirement. Another 7% of senior citizens declare personal bankruptcy every year.

FOMO panic can cause retirees to borrow money to approximate a retirement lifestyle they envy in others.

It is never a good idea to borrow money, or borrow against a modest retirement account, to satisfy FOMO panic.

Live out your retirement realistically against your budgeting needs.

Get a Financial Advisor

The only shame in not being prepared for retirement is staying unprepared.

Get a financial advisor. This is an online tool from Smart Asset which identifies 3 financial advisors in your area according to zip code.

Save more than you spend. Think about your retirement era health costs. You must create meticulously budgets that will last throughout retirement.

Your retirement may not be cool, sexy, or as interesting as others. That is OK. Your retirement is a life budget that must meet your personal finance needs throughout its entirety.

Your retirement ambitions should never be inspired by envy or the FOMO mindset.

Read More

Convince Your Boss to Convert Your Job to Remote With These 3 Tips

How To Earn Extra Income With A Mobile Phone

Using a Retirement Fund Loan to Buy a New Home – I Wish I Did That

How To Become a Part Time Real Estate Agent

Things To Know Before Applying As A Mystery Shopper

Allen Francis was an academic advisor, librarian, and college adjunct for many years with no money, no financial literacy, and no responsibility when he had money. To him, the phrase “personal finance,” contains the power that anyone has to grow their own wealth. Allen is an advocate of best personal financial practices including focusing on your needs instead of your wants, asking for help when you need it, saving and investing in your own small business.