Saving money and investing for your future are a part of what we’ve all learned through the years. What’s interesting is that this seems to be a lot harder than you’d think. If you have at least $5K in a savings account, you’re probably doing better than most of your friends, but why is that? Maybe a little financial advice from a 3×5 card can help.

So let’s take a look at this advice and see if you could use some of it to change your life.

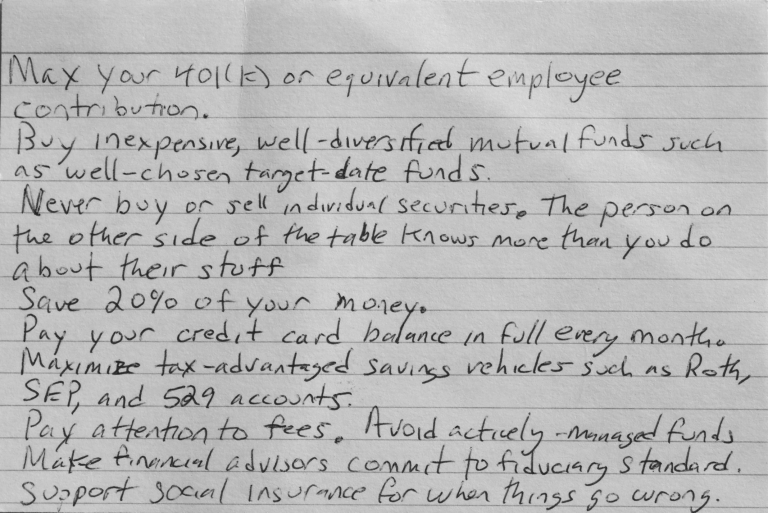

Financial Advice on the 3×5 Card

- Max out your 401(K). This may be very difficult if you have a lot of debt, so pay off your debt first. At least put enough money into your 401(K), to get the matching contribution. If you can’t do this, start with 1% of your income and then increase another 1% each time you get a raise.

- Buy inexpensive, mutual funds. Diversification can keep your funds safe. This is good advice. When you have funds that cover various industries if one or two of them fail, you won’t lose all of your money as with individual funds.

- Never buy individual stocks. The other side may have information you don’t. This advice depends on your risk tolerance. Many retail investors have done very well purchasing stocks with whom they are familiar with the products. If you are squeamish, use this advice.

- Save 20% of your income. If you have paid off your debt, then this may be attainable, if you have lots of debt, pay down your debt first. Also, it’s okay to start small. Saving $20 a week is better than saving nothing, just start now.

- Pay off those credit cards. The only advantage to keeping a balance on the credit card is to make the credit card companies richer.

- Tax Advantaged savings is great for your financial future. Well it depends, we have no idea how tax laws will change in the future and the tax advantage savings that we are using today could be worthless tomorrow. When you are ready to use the money, it also depends on how much additional income you have coming in, because at some point you are going to have to pay taxes on that money saved.

- Know the fees you are being charged by your Financial Advisor. Some fees are extremely high and you may find you’re better off investing in an index fund. Their fees are very low.

- Certified financial advisors take an oath that they will protect their clients or uphold their fiduciary duties. This is great advice. Make sure that your advisor isn’t putting you into funds that are making them rich and leaving you poor.

- Promote social insurance when things go wrong. Better advice is to build an emergency fund for when things go wrong.

Although, there is some good advice given by Professor Pollack, from the University of Chicago, you are the best judge of your financial risk tolerance. There are tons of books that give financial advice and tons of advisors. Find what works best for you and make good financial decisions.

Additional Reading

The Science of Getting Rich-Creative thinking and being of help to others can help you obtain your financial goals. This is what Wallace Wattles the author hopes you take away from this book. Like Napoleon Hill he too believes that we create the life we want by what we ask for. He provides you with action steps to take to reach your financial goals.

The Intelligent Investor-Benjamin Graham has written a great book on “value investing.” He’s been called the great financial advisor of all time. His strategies has helped investors by outlining stock selection and explaining simple strategies that investors can use.

The Essays of Warren Buffet-This is written by Warren Buffet, need I say more.

Do you think you can get financial advice from a 3×5 card? If so, we’d like to hear about it in the comments below.

Tamila McDonald has worked as a Financial Advisor for the military for past 13 years. She has taught Personal Financial classes on every subject from credit, to life insurance, as well as all other aspects of financial management. Mrs. McDonald is an AFCPE Accredited Financial Counselor and has helped her clients to meet their short-term and long-term financial goals.