Earlier this year, CF wrote about tackling big goals by breaking them down into smaller tasks. We’ve applied exactly this principle in our quest to transfer our mutual funds to a brokerage, so that we could switch to ETF investing. We’ve really been pushing to get our RRSP investments out of mutual funds due to the high management expense ration (MER) of over 2%. We recently opened an RRSP account at Questrade, who offer free ETF trading. Then, it was just a matter of transferring our mutual funds from BMO to Questrade. Here’s a summary of how to transfer your RRSP investments between banks and brokerages.

Step 1: Get a transfer form from your new broker

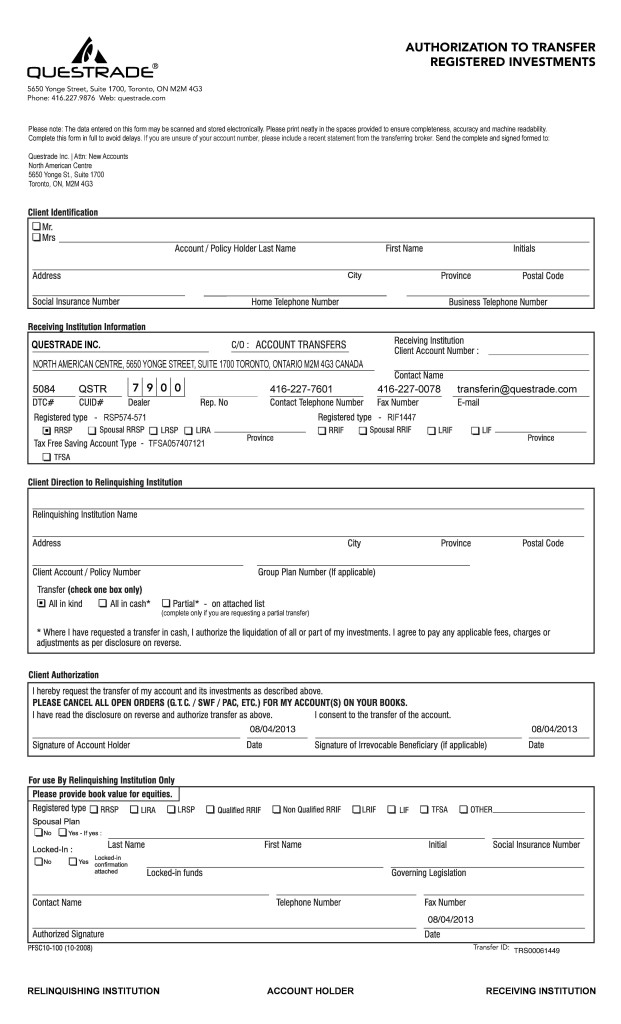

Originally, we had this backwards. We had set up an appointment with our current bank to ask them to transfer our investments to our new brokerage. It doesn’t work this way. You’ll need to download a transfer form with your new brokerage which allows them to transfer your registered holdings out of your current bank and into your new account. The Questrade form looks like this:

Step 2: Fill out the form (duh…)

Questrade allows you to enter much of the information in a widget which then pre-populates the form you download. You’ll need to know the following information:

- The name and address of your institution which you’re moving funds from.

- The account number of your RRSP you wish to move.

- Whether you want to move your investments in kind or in cash.

Since most brokerages allow you to hold pretty much anything, you can transfer your investment in kind. This means that you’ll still hold the same mutual funds or investments that you originally held, just in a different brokerage. I chose to do this so that I would not incur any additional selling fees before I transferred my funds. I will sell them via Questrade which will be cheaper than doing it via BMO and taking the cash.

Step 3: Sign and mail your completed transfer form

Once you’ve completed the form, print it out, sign it and mail it to your receiving institution. Then, wait for the money or investments to magically appear in your account! Something to keep in mind is that your receiving institution will likely charge a fee to transfer your investments. This can range betwee $75 and $150 and can usually be waived if you’re transferring a large enough portfolio. Even if you don’t automatically qualify for the free transfer fee, ask. You’d be surprised how much a new brokerage will do for your business.

Next, I’ll be selling my mutual funds and looking into some ETF’s for purchase. I’ve been brushing up on my ETF’s thanks to a book I won via a contest, so I’m looking forward to putting our plan into action!

Have you transferred registered accounts between brokerages? How was your experience? Do you have any other tips or tricks?