We are over a week into our ‘staycation’ and have been enjoying every minute of it. We have knocked off numerous coffee shops, restaurants and entertained a number of guests. We’ve only been here a month and we’ve almost had more people over than we did in an entire year at our last place. I love it. We are still waiting for our couch to arrive, and for our closet system to be installed, but we should have that all wrapped up by mid January. Then I would finally say that we’re ‘settled’.

One of my favourite, if mundane tasks during the holidays is wrapping up my yearly financials. I track my net worth pretty religiously and have archives dating back to 2010, so it’s satisfying to track my finances that way. I also keep independent yield calculations on all my RRSP investments, because you never see the MER effect on the bank statements. My major mutual fund has an MER of 2%, so my #1 priority for January is to finally switch it over to an ETF. The one thing we haven’t figured out is if we would be charged a brokerage fee every time we bought units, which would be counter productive since we invest monthly. Anyone had experience here?

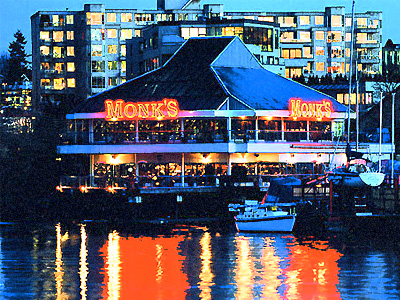

Monk McQueens

Finally, we’re heading to a local restaurant for New Year’s. They’re closing down after 26 years and have one of the most beautiful locations in the city, on the edge of False Creek. What are your New Year’s plans?

Check out these awesome posts this week!

It was a bit of a lighter blogging week with all the holidays, but thanks to those that continued to share us!