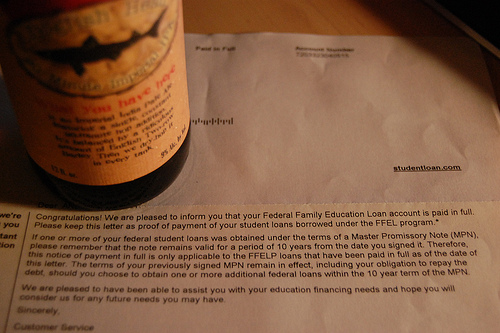

Last month I reached a major milestone towards financial independence – I paid off my Student Loan! I graduated in April of 2008, so all in all, I took 3 years and 10 months to pay back $13,000 to the government. Had my friends at the National Student Loan Service Centre had their way, it would have been over 8 years before I had repaid my loan in full and I would have paid much more in interest over the extra 5 years.

Photo Credit: choking sun (http://www.flickr.com/photos/chokingsun/5325112509/)

Pay more than the minimum

Unfortunately, when I started paying of my loans, I did not keep nearly as many detailed financial records as I do now. As I recall, my monthly instalment when I first started paying back my loan was only $130. Because I did have some idea that at the time that paying more than the minimum was a good idea, I upped that to $200 immediately. Suddenly, my loan shrunk from over 8 years to less than 5! Just by increasing my monthly payment by $70, I cut 3 years off of my loan.

Use the debt snowball!

The debt snowball is a concept popularised by personal finance advocate Dave Ramsey. The idea is that you identify your highest interest debt and make only minimum payments on all other debts. All your extra money is then funnelled towards the highest interest debt until it’s gone – then you move on to the next highest interest rate. For most, your highest interest debt will be your credit card. As I don’t have any credit card debt, I can thankfully skip that one. At a variable floating rate of prime + 2.5%, my Student Loan represented my highest interest debt.

In August 2010, I was unexpectedly unemployed and used that opportunity to qualify for a 6 month interest free period on my loan. Thanks to CF’s knack for finding jobs, I was only unemployed for a month – this gave me 5 months to really make hay on the loan. I decided in my new budget to make the Student Loan a priority, and started making monthly payments of $500 to pay off the loan as quickly as possible. On Thursday, February 23rd, I hit the ‘transfer’ button and became Student Loan free!

What now?

You might be thinking – only $13,000? Didn’t he take a four year University degree? Well, you’re right, I do have more debt to pay off my schooling, but this is in the form of an interest free loan from my parents. While it is tempting to take the $500 and roll it right into payments on that loan, it is more efficient to split it between TFSA/RRSP investments and make smaller payments on the loan. The return I will get on the investments will be greater (on average) than the 0% I would be saving myself by paying the loan back sooner.

If my parents needed the money imminently, then the loan would be a higher priority, but for now we have agreed on a smaller monthly payment. Lending money between family members can be a tricky subject – I suggest open and honest communication so the expectations are clear.

***

I am looking forward to re-budgeting and contributing more money to my TFSA and RRSP investments from here on! Putting more money towards these investments should help my net worth grow at a faster rate over time than by paying down a low interest debt.

Got a loan story or questions? Post it in the comments below and I’ll be sure to respond.