Older generations tend to harp on the mistakes of the younger ones. However, the millennial generation (born 1980-2000) seems to receive the brunt of recent criticisms. But, is there some truth in their observations? The way millennials view and manage money is vastly different than previous generations. And, this isn’t always a good thing. Many consider our generation to be the least financially literate and much worse off than generations before us. Although not true for everyone, there are some mistakes many of us seem to be making when it comes to financial planning. Here are 10 of the biggest financial mistakes millennials make.

The 10 Biggest Financial Mistakes Millennials Make

1. Racking up mountains of debt

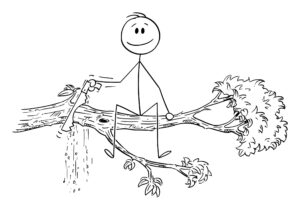

For many students, debt seems to be a natural part of life. Then there are car loans, mortgages, and credit cards to contend with. When you’re young, debt might not seem like a big deal with years ahead to work and pay it off. However, this attitude towards money can bury you with years of financial burdens.

While some debt is unavoidable, many find themselves deep in debt before they even start their career. Choosing to ignore or avoid the issue will only compound your problems. You will end up paying more in interest and penalties, causing you to fall even deeper into debt and perpetuating the ugly cycle. If you have significant debts, it’s time to take control of your finances before they become an even greater financial liability.

2. Not investing

Speaking from personal experience, I was more focused on surviving than investing when I was in my 20s. When you’re drowning in debt, saving for retirement becomes less of a priority. But even if you have other financial obligations, you need to plan ahead and prepare for your golden years.

If ever want to be financially independent or build wealth, you’ll need more than your salary. Though contrary to what people think, you don’t need a ton of capital to get started. Don’t waste these early years, or you’ll miss out on the compounding interest. The earlier you start, the greater the returns on your investments.

3. Not taking advantage of employee benefits

Another one of the worst financial mistakes millennials make is not taking full advantage of their employee benefits. Now that pensions are a thing of the past, many companies offer employer-sponsored 401(k) accounts with contribution matching instead. Unfortunately, many younger employers forego these benefits and put off investing altogether. But, if you aren’t utilizing these retirement accounts, you’re leaving free money on the table. These supplemental accounts will be even more important for future generations since Social Security benefits won’t be enough to cover expenses.

4. No emergency fund

Today, nearly 64% of Americans are living from paycheck to paycheck. Those who are counting their pennies aren’t likely to put anything in their rainy day fund. Creating an emergency fund probably seems less important than paying your bills and affording basic necessities. But, when you get hit with unexpected expenses, an emergency fund can save you from financial ruin. Having this safety net can protect you when disaster strikes.

5. Opting out of health insurance

When you’re young and healthy, you may not need to visit a doctor frequently. And with rising premiums and overall costs, health insurance becomes less of a priority if you are on a limited budget. However, you can’t take your health for granted. These expenses will increase as you get older. And, if you have an accident or endure a serious injury, health care costs could impact your financial health.

6. Overspending on rent

Experts agree that you should only spend about 30% of your income on housing and utilities. Sadly, half of us millennials spend more than this. This is partially due to suppressed wages and the increased cost of living, partially a result of the current housing market. With prices skyrocketing, owning a home seems like an impossible dream for some. There are fewer homeowners within this age range than in any previous generation.

Many choose to rent from necessity and convenience. But, renting long-term is one of the biggest financial mistakes that millennials make. In the end, you spend more on monthly rent payments than you would on a mortgage. So, you are basically giving your money to someone else instead of building equity.

7. Not having renter’s insurance

Another huge misstep millennials make is not having renters’ insurance. Even if you don’t own your home, you should always have insurance. It will cover any damages to the structure and your belongings in case of natural disasters such as fires or floods. And, it will protect you against theft as well. Those who don’t hold renters’ insurance will have to pay these losses out of pocket.

8. Sacrificing their credit

When times get desperate, there are few options left other than to take a loan or use credit cards. Having your credit score take a hit seems better than the alternatives. However, the long-term effects it has are more harmful than you may realize.

You’ll need a good credit score to rent an apartment or secure a loan for a car or home. And, many employers check your credit score during the interview process, especially if you are applying to a bank or a position that requires a high-security clearance. Therefore, use your credit wisely and keep a healthy debt-to-income ratio. If you have bad credit, there are several ways you can improve your credit score.

9. Impulse buying

There has been a huge increase in online shopping, especially during the pandemic. And, online retailers are tapping into this trend. Not only are they using more target marketing, but also offering irresistible deals. Those who are prone to impulse buying can easily blow their budget. Even those who don’t are more likely to spend since they are bombarded with advertisements on social media. If you can’t afford these shopping sprees, delete those apps and restrict your screen time to avoid temptation.

10. Not asking for help

While self-sufficiency and financial independence are admirable, many people struggle to reach these goals. We are only human and make mistakes. Whether it is from a lack of opportunity and financial education, poor money management skills, or foolish decisions, you aren’t alone. It can be difficult, but it is okay to ask for help. When you don’t have all the answers, consult with a financial advisor who can find them.

Read More

Jenny Smedra is an avid world traveler, ESL teacher, former archaeologist, and freelance writer. Choosing a life abroad had strengthened her commitment to finding ways to bring people together across language and cultural barriers. While most of her time is dedicated to either working with children, she also enjoys good friends, good food, and new adventures.