There are three keys to profitable investing: (1) possessing something of high financial value, (2) understanding the financial market in which its’ value is cherished, and (3) understanding how to get profitable returns from your investment. However, investments don’t always involve stocks. An investment can be a relative term depending on what you, and buyers, think is valuable. Do your research and learn the market. There are a lot of odd investments that may reward you with surprisingly high returns.

Returns on Your Investments

There are no absolute answers to when or the exact amounts you should expect for returns on investments. It could take years to get an ROI. But, there are some guidelines to assist with your financial planning. Most financial planners follow the golden rule and set expected returns at 7% annually. Unfortunately, even this idea is only a mischaracterization of an old Warren Buffett quote on the subject.

There is no such thing as easy money and investing is not a get-rich-quick scheme. You must research and know what you are doing. However, there is always more than one way to invest. From artwork and cars to storage unit facilities, here are several odd investments that have been very profitable for lucky investors.

5 Odd Investments with High Returns

1. Couple Sells $100 Used Car to Elon Musk for $1 Million

I can’t stand reality TV shows about people who bid on auctioned storage lockers because it highlights an ugly truth about American culture. It demonstrates just how wasteful our consumeristic society has become. How is it possible that people “forget” about paying to rent space to store their possessions? Then, these disposable possessions get seized by the storage company and auctioned away for pennies on the dollar. The worst part is when highly valuable items turn up in the forgotten storage unit lockers. For example, odd investments worth $1 million or more.

In 1989, a New York City couple bought a storage unit at a blind auction for only $100. However, among the items in the unit was something truly priceless: a 1976 Lotus Esprit sports car. The car was infamously depicted as a car/mini-sub hybrid machine in the 1977 James Bond action film, The Spy Who Loved Me.

But, the couple didn’t have a clue what they had on their hands. While moving the vehicle onto a tow truck, truckers passing by chatted it up on CB radio and contacted the couple’s movers. Long story short, the couple restored it and sold the car to Elon Musk for $1 million in 2019.

This would have been a very different story if they left the car in storage or passing truckers hadn’t recognized it. Many odd investments go unappreciated. That’s why you should always know what you’re buying. Even in a blind storage unit auction, inventory what you have after the sale.

2. Contemporary Art

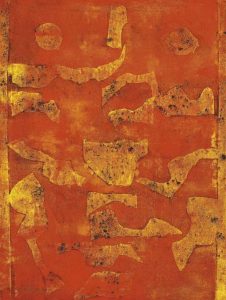

(Image courtesy CEA+ via CC BY 2.0) Vasudeo Gaitonde’s Untitled (1987)

The art market on a whole offers about a 5.3% return on investment. Many advisors will tell you that investing in art for the sake of healthy returns is usually a bad bet. Annual art maintenance and tax obligations can be exorbitant. Yet, some contemporary art investments offer as much as 7.5% return on your investment.

To get these kinds of results, you must know what you are investing in and understand the art market. For example, knowing which contemporary artists are more likely to offer larger returns will improve your chances. The works of French-American artist Marcel Duchamp offer an annual return of 465% or 93% after three years. The works of abstract Indian painter Vasudeo Gaitonde offer an annual return of 198.1% or 83% over three years. Even if you are unfamiliar with art, you may still know the name, Jackson Pollack. A Pollack painting can bring an annual return of 320% or 57.5% over three years.

The best way to get value for your money is to create networks or gain access to an agent with in-roads to the art market. If you come across any non-descript art, get it professionally appraised. Pieces of art are odd investments because only a handful of artists create work that will ever be valuable.

3. Extremely Rare Coins

$20 coin circa 1907.

How do you make money on rare coin investments? As with all collectibles, you must know what you own and have it professionally appraised. When it comes to coins, rarity is key. Most rare coins offer 10.1% returns in a year or 13.2% over three years.

Some coins are rare because they are one of a kind. A 1794 silver dollar, believed to be the first silver dollar ever printed, sold for $10 million in August 2020. Other coins are very rare because they have errors. Some coins are accidentally struck twice in a press, causing surface deformities. These “double strike” coins are supposed to be destroyed immediately. However, many reach public circulation. If you are fortunate enough to find a rare coin, they could bring a pretty penny.

Some rare coins are just error coins. This penny was struck off-center, leaving most of the coin blank, well…blank. If you have a coin like this, get it appraised today.

4. Childhood Toys and Memorabilia

Other odd investments that can have surprisingly high returns are childhood toys and memorabilia. Vintage toys have seen a huge resurgence in popularity and are selling for thousands of dollars. Just recently, a rare Pokemon trading card sold for over $300,000 at auction. And, it isn’t only trading cards that collectors are looking for. Comic books, action figures, Beanie Babies, Barbies, Legos, Hot Wheels, and movie paraphernalia are all the rage right now.

However, the condition of these items will have a huge impact on their value. Items in mint condition or still in the original packaging have the highest value. But, if you still have any childhood toys or collectibles, they could be worth more than you think.

5. Storage Units

Instead of rifling through your storage unit, why not manage one and charge people to manage theirs? Most storage unit businesses offer a 16% annual return on investment. Some offer as much as 21.2% ROI after three years. A standard storage unit can cost $60 to $180 a month. You can even climate-controlled storage units that cost $75 to $225 a month. If you manage a storage unit facility, you will never hurt for business. And, you never know what hidden treasures people will leave behind. If there is one thing Americans excel at, it’s hoarding. Over 65% of Americans who rent a storage unit also have a garage!

Get a Business Plan

When looking at investment options, alternative investments and assets could bring large returns. Now, I don’t mean to imply that starting a business or engaging in odd investments will be a slam dunk for you. However, if you decide to venture into odd investments, you need to have a business plan. Do your due diligence and make sure that you understand the market you will be investing in. And, most importantly, make sure you understand your demographic and the consumer base you will cater to via your investments.

Read More

Jenny Smedra is an avid world traveler, ESL teacher, former archaeologist, and freelance writer. Choosing a life abroad had strengthened her commitment to finding ways to bring people together across language and cultural barriers. While most of her time is dedicated to either working with children, she also enjoys good friends, good food, and new adventures.