Over the last month, we’ve been going through the process of transferring our mortgage from Vancity to TD Bank. Our five year term with Vancity is not due until 2015, and we pay three months interest in penalty to Vancity for breaking the terms of our mortgage. Why are we doing it? TD was able to offer us a rate that was 0.85% lower than Vancity. When you’re talking about a mortgage worth over $225,000, being able to get the best mortgage rates makes a big difference.

The process should have been straightforward, but ended up dragging out over a number of weeks. The delays and issues that arose highlighted the need for vigilance and due diligence whenever signing documents for a large sum of money. A few pointers:

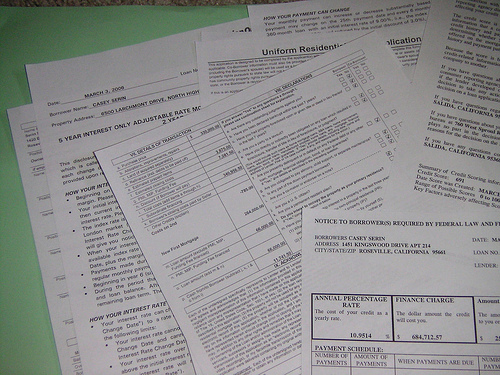

Photo Credit: Casey Serin (http://www.flickr.com/photos/sercasey/872359968/)

Ask for a full financial breakdown

It’s easy to calculate how much 0.85% of the total mortgage amount is. Based on this type of calculation, we will save approximately $2,000 in interest each year. However, bank’s don’t calculate interest using ‘simple math’ and often front load interest payments (so you pay more interest initially and less over time) while keeping the total interest paid consistent with you interest rate. Rather than figure out the math, have your account manager provide you with a full breakdown. They want your business, so it’s in their best interest to help you out. After comparing our mortgage balance projections at Vancity and TD, we will be back to our original pre-transfer balance by March of next year. After that, our lower interest rate will knock down our mortgage faster than if we stayed with Vancity.

Double check the numbers before signing

Since our mortgage manager was not based out of a branch, he set up an appointment for us to visit with a branch representative to sign the new mortgage documents. When we arrived at the branch, we noticed that the documents did not reflect the numbers that were discussed with our mortgage manger. If we were not careful, we could have ended up signing a loan agreement for $5,000 more than we expected, which would have negated the advantage of switching.

Don’t sign anything you’re not comfortable with

The branch representative was convinced that the numbers were right, and our mortgage manager even thought it was correct at first. We were not pleased and did not sign the documents – a wasted Saturday morning spent driving out to Burnaby! A few days later, our mortgage manager called and apologized for the mistake. After the numbers were adjusted, we made another appointment (with a different branch representative!) and signed the corrected documents.

***

Now that everything is squared away, it’s back to making more than our monthly payments, saving for a yearly lump sum payment and watching our balance steadily fall! Have you recently switched banks or tried to compare mortgage rates? Is the hassle of moving your mortgage worth the savings? Have a good mortgage story to tell? Post it in the comments!