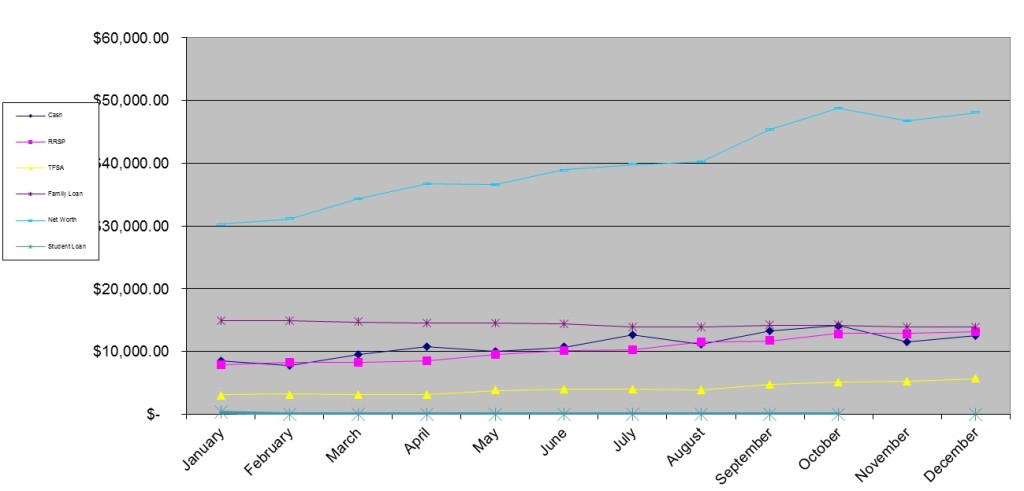

The last few months have featured a lot of changes for us. And since Brian and I have added another condo to the mix, I’ve gotten a new job (again), and my student loans have come up for repayment (again), it seemed like a good time to do a net worth check in. I usually do this for myself every other month, but we don’t usually post about it more than a few times a year. I mean, do you guys really want to know what I have in the bank every week? However, this will provide a good benchmark for us and perhaps we’ll do an update in another 3 or 4 months. Interested in calculating your own Net Worth? Check out our template in the Tools section.

CF

Assets

$300,000 – condo

$9,511.12 – personal RRSP

$100 – company RRSP

$2800 – old company pension

$4200 – company stock options

$3,285.36 – TFSA

$1500 – emergency fund

$508.78 – irregular savings fund

$522.72 – chequing buffer

Debts

$284,617.50 – mortgage

$27,174.78 – student loan

$4000 – RRSP HB loan

CF net worth: $6,635.70

This will probably jump part way through next year because I don’t receive my matching company RRSP contribution till mid-year.

BP

Assets

$265,000 – condo

$13,114 – personal RRSP

$5623 – TFSA

$4187 – emergency fund

$4280 – irregular savings fund

$856 – chequing buffer

$1559 – chquing accounts

$1085 – condo maintenance fund

Debts

$228,775 – mortgage

$13,875 – family loan (school)

Brian’s net worth: $53,054

Brian’s note: My Net Worth goal for 2012 was actually $65,000, so I didn’t meet my target. It probably wasn’t realistic! My net worth still increased by 73% this year, so I’m pretty happy with that.

Our focus in 2013 will be on paying down student loan debt and the mortgages. We probably won’t consider buying more property again in the near future unless we sell the first condo.