Have you heard of Planwise yet? They’re an up and coming San Francisco based technology company that has created a pretty slick web app to help consumers plan out their finances. The basic idea is that you give the app your financial stats – income, expenses, debts and so on – and then add “Plans” on top off your baseline. Plans could be things like taking out a new loan or getting a new job. The app then shows you how your finances are changed by the new Plan.

We’ve had Planwise on our site for a few months now but haven’t used it for any in-depth analysis yet. Since I’m starting a new job, I thought it’d be fun and informative to put Planwise through its paces and see how my finances add up. Note: The sizing of the widget is also a bit off, so turn your heads sideways, count to ten and squint – ie. we’re working on it. If it bothers you, you can also try the version on their website.

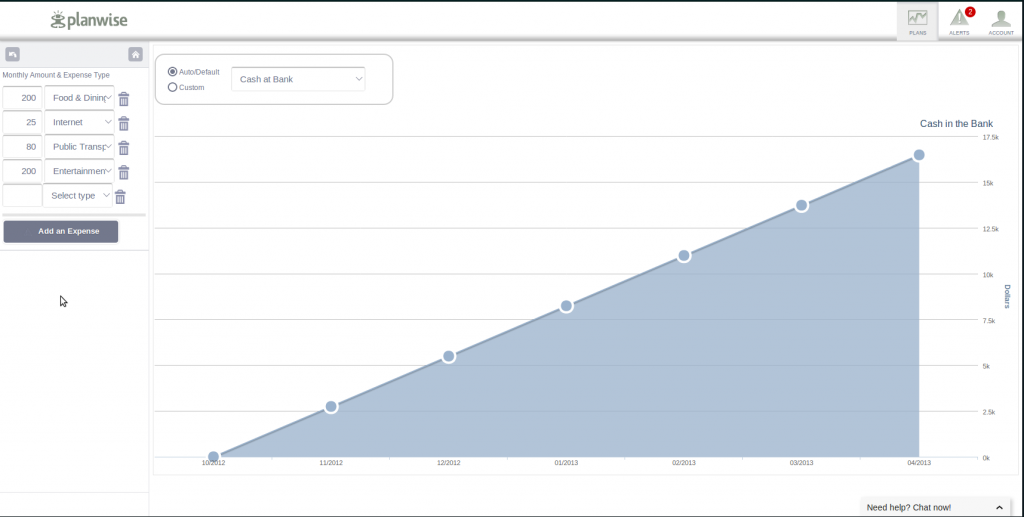

First, you add in your basic financial information – your monthly salary, your expenses and your current debt payments. It’s pretty easy to navigate the system – literally point and click. When you enter your salary, Planwise creates a little graph that shows how much money you have month after month based on that salary. As you add expenses using the drop down menu to the left, that total amount goes down accordingly. If you want to remove an item, just click the little garbage can beside the entry.

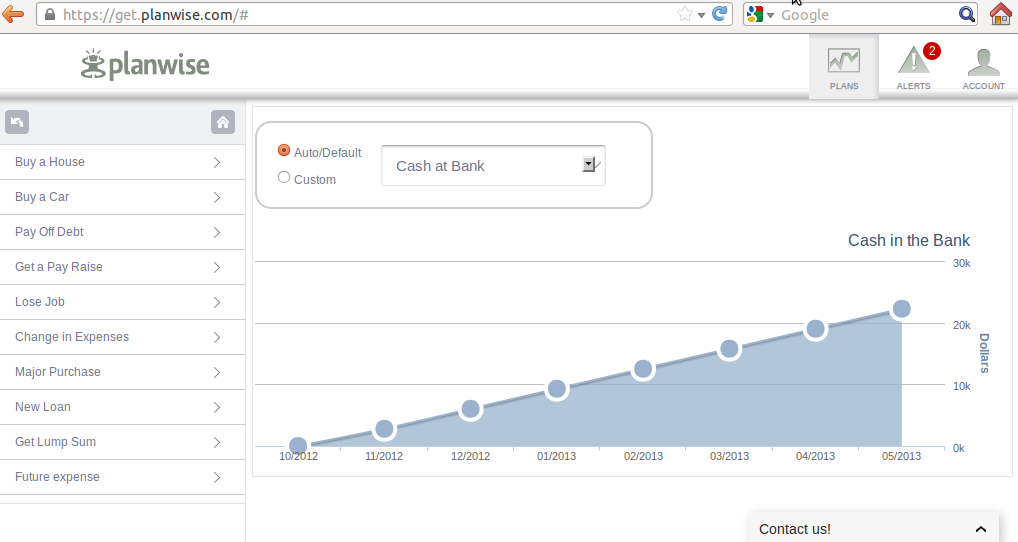

Next, I’m going to add my new job. From the home screen, you can navigate to “Plans” and choose an event. There’s no new job event, so I’m going to use the “Get a Pay Raise” event. After I enter in my new monthly salary, the graph automatically changes to illustrate my cash flow with the change.

Other events include losing a job, getting a loan or making a major purchase. Each event has custom fields that you can enter to make the calculations more realistic. For example, if you enter a new loan, it accounts for the interest rate and term of the loan. Neat!

On first glance, using Planwise to illustrate my budget is a good way to visualize my money. As you add more expenses, you can literally see your money disappearing. It’s not as flexible as using the old pen and paper, of course, but I think that many people would find the graphical representation useful. Planwise can be a really useful tool to plan for big expenses in the future, like saving for a car or house. The variables they are able to incorporate are quite impressive and represent a really accurate picture of what your finances will look like in the future. You just need to do the work to feed it the right information. For me, it’s a good way to realistically visualize my finances in the future, without hand-wavey approximations.

As Planwise evolves, I expect we will see more features and capabilities. Last week, they announced a major update which includes Alerts.

Have you tried Planwise? What are your thoughts?