Pfew, what a week. As you might have guessed with the real estate themed posts lately, we’re exploring the market and looking to buy a second condo in the area. Nothing firm to share yet, but we’ll definitely share some details when we have enough information to warrant an update. It’s been a busy week around the web as well and I think this is the biggest list of blogs and mentions we’ve had yet. Thank you to everyone who’s stopped by and shared our content! An extra thank you to Jason from Work Save Live for his guest post on Understanding US Retirement Investment Accounts. It’s a topic I don’t know a lot about, so thanks for sharing your knowledge with us north of the border.

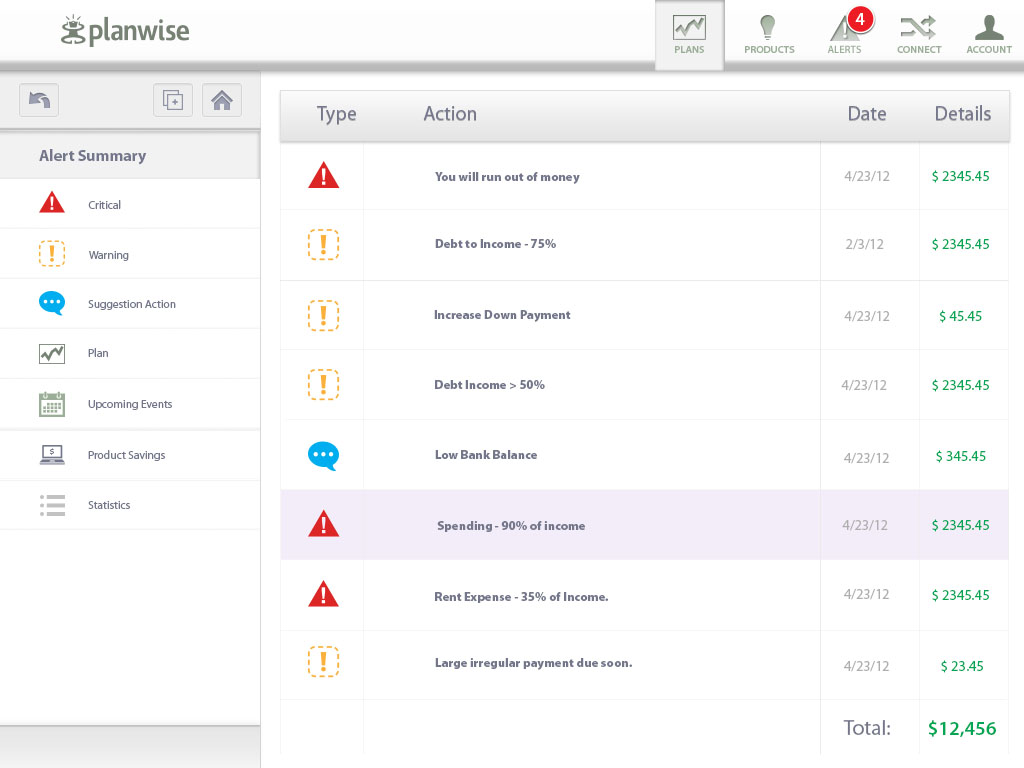

We also published our first guest post this week over at Planwise – Eating well while eating cheap. Planwise is set to release some major updates on Monday which look pretty cool. I especially like the new Alerts feature which provides helpful information like when you will run out of money, or when your debt to income ratio is too high. Here’s a sneak preview!

Don’t forget, you can check out the current version without even leaving this blog! Check out our Tools section for a built in version of Planwise.

The fall harvest is starting to wind down at the garden and we’ll be picking most of what’s left tomorrow before preparing the plot for winter. We’ve got a few winter plants, namely kale and our mystery plant, so I’m looking forward to that. Stay tuned for some more news on the condo front and check out these great posts in the meantime!

- Mrs. Plunged In Debt talks about one of CF’s most favourite topics, science degrees. It’s a great personal story of another Biology refugee who realized that there are great jobs out there for smart people that don’t involve making pennies while slaving away in a laboratory.

- JT at 20s Finances talks about the ins and outs of diversification. It’s a quick read but very informative and provides a clear explanation of the topic.

- For most of CF’s early 20s, she was preoccupied with how much I should pay for rent. She would often move every year or two in order to escape rent increases! Veronica at Pelican on Money talks about this topic on her blog and suggests that you should look at your budget first and foremost.

- It’s coming up to the start of a new month, which means the grocery budget is re-set. This month, I’m going to attempt The Grocery Game Challenge from Canadian Budget Binder!

- Evolving Personal Finance looks at the costs of finding a new job. I think it’s different in every industry, but don’t expect your potential employer to foot the bill if you have to fly in from out of town to interview.

- One of my favourite philosophical bloggers was back at it this week. Brave New Life looked at The Retirement Identity Gap as a way of answering the question “what are you going to do with all your time when you retire early?”

- CF and I are a big fan of free stuff on craigslist. Freedom Thirty Five Blog also made some great discoveries and encourages us to Find Freebies Online.

- My Alternate Life advises everyone to Start Saving for Christmas Now! I fully agree – part of my budget every year goes to ‘gifts’. Year round, I’m saving for birthdays, celebrations and Christmas!

- John at Frugal Rules reminds us that credit cards are not inherently bad. It’s true, but if the companies didn’t make money off the interest and everyone paid off their balance every month, there would be no reason for companies to offer credit cards.

- Jason at Work Save Live had a great Kale Salad recipe. We just planted Kale for the winter in our garden, so we might get to try this recipe out!

Thanks to everyone who included us this week: