A lot of people I know have been starting first jobs lately. And first jobs means… more beer first budget! Well, maybe it doesn’t mean that to most people and certainly not to me way back when – but getting started on a good solid budget right from the beginning will set you up for future financial success.

Photo Credit: http://www.flickr.com/photos/twon/

When I had my first regular job, I was living off my student loan. I decided to put half of my paycheque into a savings account and take out half to spend. It was an attempt at a “budget” but really, all it did was keep me tied to my student loan for expenses while giving me an extravagant amount of spending money. I did manage to get a bit of savings out of this tactic but it was far outweighed by my massive student loan bill.

So how do you go about setting up your first budget? I say – start with the basics and keep it simple.

It’s all about the inputs and outputs

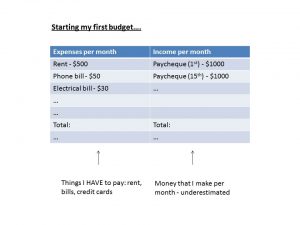

The first question and most important question is – how much money do you have coming in and going out each month? To figure this out, grab a piece of paper and start a running tally. On one side, write down your expenses. This includes things you MUST pay, like rent and bills. Do not include expenses like “food” or “entertainment” yet. On the other side, write down your all your regular sources of income for the month. This will usually just be your salary divided by 12 or your estimated hourly earnings for a month. Remember to always underestimate! Then, write down your temporary totals for both sides.

Starting to develop the budget

Now if your expenses are already higher than your income – you’re in trouble. This means you don’t even make enough money to pay all your bills, much less eat or entertain yourself! Maybe it’s time to look at cutting your expenses drastically.

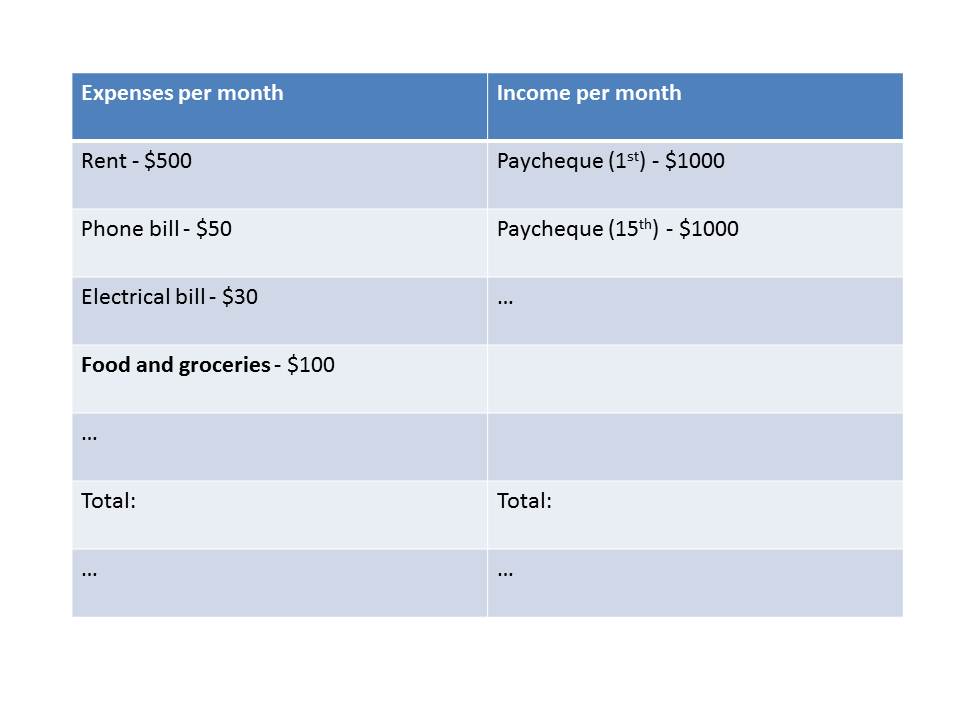

Keeping yourself fed

After paying off the bills, a person has to eat. How much you spend on food varies incredibly per person and with different lifestyles. I firmly believe that a good diet can be had for $100 per month per person in groceries – that means that this does not involve eating out (more on that later). However, if you are just starting out with budgeting, maybe $100 per person is too much of a change. That’s okay! Start with $150 or even $200 and see what you can trim from there.

Add groceries to your budget in the expenses column along with the appropriate amount then recalculate the total. Again, if your expenses become higher than your income, you will have to cut back. Either choose a smaller food budget, re-examine your bills (do you really need cable?) or look at more drastic options.

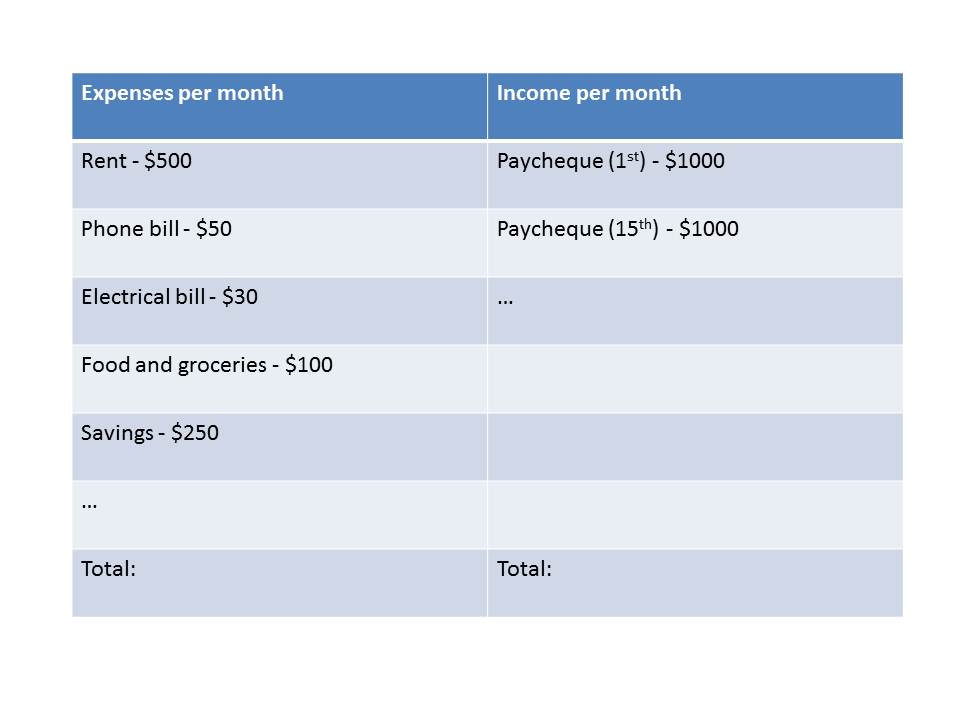

Saving for the future

Before you can even contemplate your spending and entertainment budget, you need to look at your savings. People throw around a lot of numbers for savings, but a commonly suggested amount is 10% of your pay. However, if you can save more – why not?? Of course, this depends on your situation. If you have a lot of debt, maybe you want to save 10% and add 5% of extra payments towards your credit card debt. If you have no debt, maybe you want to save 20% a month and divide that amount between short term savings (a car or a downpayment) and long term savings (emergency funds and retirement funds).

Since this is geared towards a first-job, first-budget scenario, I would suggest a modest 10-15% of your pay cheque be allocated towards savings with some of that going towards an emergency fund and some going towards additional debt payments (= EXTRA payments on top of your regular bill amount). If there are no debt payments (good for you!), then I would suggest splitting that savings amount between an emergency fund and a retirement fund.

To calculate 10-15% of your pay, take your monthly income and multiply it by the fractional percentage. So for example, if you want to save 10%, do: (monthly income) x (0.10) = this is my savings

Once you’ve figured out a tentative amount to save, add it to your budget and total up the columns. Again, make sure that your expenses do not exceed your income. If it does, then you might be tempted to think that you don’t have enough money to contribute to savings. While this might be true on paper, take a look back at your budget – what areas can you trim? Perhaps you can slash $10 a month from the food budget or choose a phone plan that’s $5 cheaper. If you don’t think you can trim anything, consider taking on extra side jobs temporarily and throw that extra income towards your debts and towards building an emergency fund.

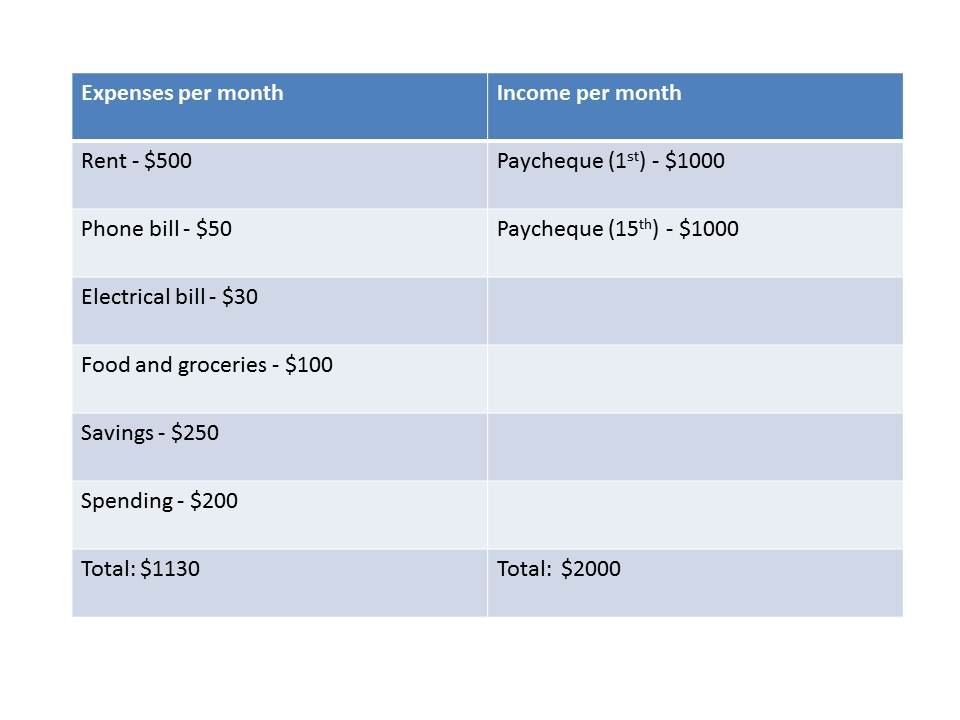

And finally, the fun money

Now you’ve covered all of your bills, expenses and hopefully taken care of savings, you can consider your fun money. For me, my “spending money” includes all of my entertainment such as coffee with friends, a dinner or movie out, and things like books or video games.

Fun money can get us into trouble when we spend more than we should. There’s lots of ways to deal with this, but for a first budget, I suggest keeping it simple – just allocate yourself a certain amount of money per month. Then every week, take out the correct fraction of that amount in CASH.

For example – Say you give yourself $200 per month in spending money and you decide to take out money on Friday. In a four-Friday month, you would take out $200/4 = $50 each Friday. In a five-Friday month, you would take out $200/5 = $40 each Friday. That’s a latte every day each week, a nice dinner out, or your half of dinner and a movie.

The rules are simple. You can use this spending money for anything you want at all, no matter how frivolous, but once you’ve spent all of your cash, you are not allowed to take out any more until the next withdraw date. Since it’s in cash, it’s easy to keep track of. And since you are not tracking every dollar you spend, it is simple. So if you are a latte per day kind of person, you CAN have your latte, every day. But if you run out of money by Wednesday, you will not be having lunch with your co-workers on Wednesday.

How much spending money you give yourself really depends on how much money you make, how much you have left in your budget and what your goals are. Obviously, if you have lofty savings goals, you should probably give yourself less spending money. For myself, I have gone between having $400/month in spending (faaaaaar too much, but that was my “first” budget) to having only $40 per month in spending. For most people, having between $20 and $80 in cash per week for spending should be more than enough. If you’re stuck and want a number to start at, try $200 per month and fiddle with it from there.

Now figure out your monthly spending allocation and add it to your budget. Make sure your expenses are still lower than your income!

What’s next?

So you’ve gone and done your budget. Along the way, you’ve tweaked and fiddled with some bills and allocations and hopefully you’ve made it work. If it didn’t work, you’ve considered some alternatives for saving more money or making more money. And if it did work, maybe that’s the end of it!

But maybe you’ve finished and you still have unallocated earned income. In our example above, our imaginary person doesn’t have a lot of debt, has cheap rent and makes $2000 a month. After budgeting, that’s $870 per month left that’s unallocated. That’s probably unrealistic, since our imaginary tally sheet didn’t include transportation costs or debts.

However, assuming your have a little bit left over, you can now get into the finer details of budgeting. Maybe you want to save up for yearly but irregular expenses like Christmas gifts, insurance, and birthdays. Maybe you want to throw more money onto your debts or into your investments and savings. Or maybe you just want to give yourself more spending money per week!

For our imaginary budget, I would probably add transportation costs into his budget, bump up his savings to include allocated yearly amounts for insurance, gifts, clothing and travel, and then consider bumping up his food and spending allocations. The important part is adjusting the budget based on what is important to your lifestyle.

Once you’re done tweaking, your expenses should be equal to or less than your income. Brilliant.

Now all you have to do is follow your budget. 😉